According to a new study by the European Union Intellectual Property Office (EUIPO), the downward trend in piracy from previous years has reversed and started to rise again. Television content is the main target of digital piracy. The most commonly exploited content includes TV shows, series and on-demand films, anime, live sporting events and specialised sports channels.

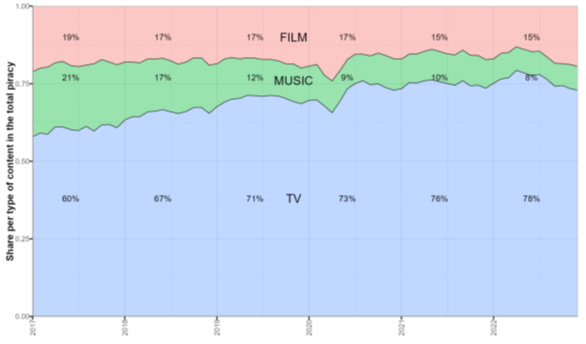

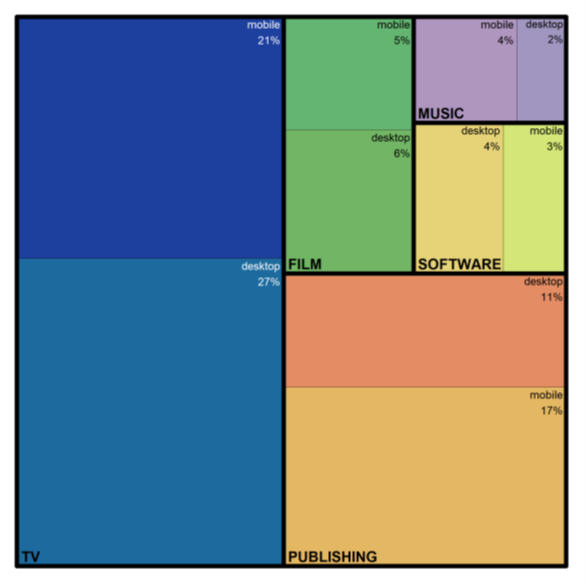

The study Online Copyright Infringement in the European Union, a follow-up to the 2019 and 2021 study, focused on the consumption of infringing content in the 27 EU Member States, covering TV, music and film between 2017 and 2022. For the first time, the study also covered publications and software for desktop and mobile devices.

Copyright protection in the EU

In the EU, the general rule is that authors’ rights are protected during their lifetime and for 70 years after their death. The protection afforded by related rights lasts for 50 years after the publication of a performance, film or broadcast and 70 years for sound recordings or performances kept on sound recordings.

The economic aspects of copyright are complicated. They reflect trade-offs between the interests of creators, distributors, performers, and consumers. The general objective of the system is to ensure that creators and other right holders are adequately compensated, as without this it would be impossible to maintain a socially optimal level of creative activity. At the same time, there is a need to ensure wide public access to creative works.

Types of copyright infringement

By using copyright-protected works without the copyright holder’s permission, digital pirates commit copyright infringement and deprive creators of the profits they need to cover the high costs of producing their works. Copyright infringement can take many forms:

- Infringement involving physical communication media:Illegal copies of optical discs (LD, VCD, DVD) and inexpensive copying using optical media and decryption software.

- Online piracy: Unlicensed use of works on the internet to distribute and provide access to films, music, TV, software and publications to other internet users.

- Signal theft:Receiving cable TV or radio system or satellite signals without authorisation or piracy through the supply to consumers of illegal cable decoders or satellite descramblers.

- Broadcast piracy: On-air broadcasting of a programme, from a legitimate or pirate copy, without permission from the copyright holder.

- Unauthorised public performance: An institution or commercial entity showing a programme to its members or customers without permission from the copyright holder.

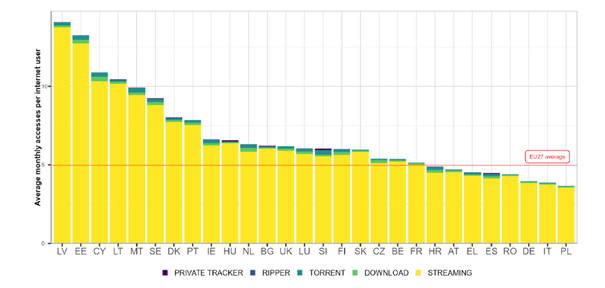

Unauthorised access to online content includes streaming, downloading, ripping and torrenting. 58% of piracy in the EU occurs through streaming and 32% through downloading.

Digital piracy is a major problem, which is why it was the subject of the EUIPO’s study Online Copyright Infringement in the European Union, which analysed the illegal online consumption of copyright-protected TV, music, film, software and publishing content in EU Member States and the UK over the period 2017-2022. Let’s take a closer look at the evolution of TV piracy.

Current availability and offer of legal TV channels

Overall, the legal supply of TV channels, films and music has increased significantly in most EU Member States since 2018. The availability of TV channels has increased by around 2.5% in the EU.

However, developments vary considerably from country to country. According to the European Audiovisual Observatory, Italy has the highest number of TV channels in the EU, despite a decrease from 2,701 in 2018 to 2,274 in 2023. In the Czech Republic, the number of channels will increase from 1,310 in 2018 to 1,588 in 2023.

According to the study, TV content accounts for half of piracy

According to the study, TV content is the most common target of online piracy in the EU. It saw an increase in 2021, with the figure levelling off in 2022. In 2022, pirated TV content increased by 15%. Among the genres most often targeted by digital piracy, TV shows, series and on-demand films lead the list, followed by anime productions (series and films), live sporting events and dedicated sports channels. TV piracy accounted for almost half (48%) of all infringing access in the EU in 2022.

Among the types of TV piracy, streaming leads

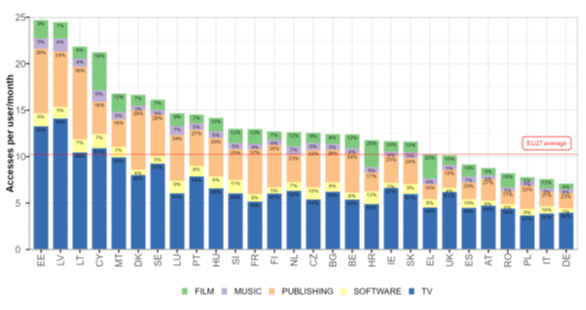

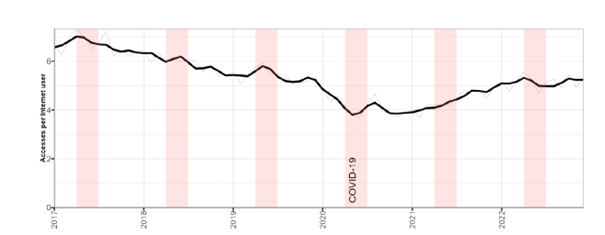

The average number of accesses to TV content in the EU27 is around 5 per internet user per month, well below the 2017 level but 20% above the 2020 floor. By comparison, the total piracy figure was 7 accesses per internet user per month.

The structure of pirated TV content consumption is similar in most EU Member States, although in a few countries there are significant differences between them and between months.

Seasonally adjusted evolution of piracy in the EU27 (accesses per capita/month); Source: EUIPO

Streaming is by far the most common way of consuming pirated TV content, accounting for up to 95% of cases.

Average monthly accesses to TV per country, with split per access method (2022); Source: EUIPO

Desktops still have a slight edge

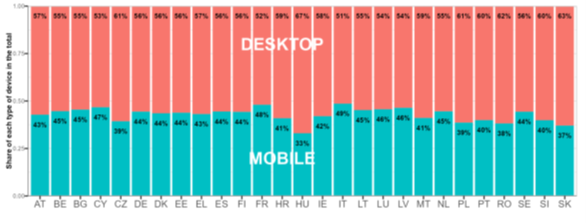

Access from desktops is still the most common way to exploit TV content, although the use of mobile devices is also on the rise. Desktop computers account for 50-60% of the total. The split between mobile and desktop piracy varies quite a lot from country to country.

As shown in the figure below, the Czech Republic is one of the countries where mobile devices are used for piracy (compared to other countries) to a low extent (61% desktops, 39% mobile devices). The use of mobile devices is lowest in Hungary (33%) and highest in Italy (49%).

TV piracy with breakdown per device type and country (2022); Source: EUIPO

The situation is complex and there are not many options

The phenomenon of internet piracy is a serious problem that requires a deeper understanding of the nature of piracy, the motives of pirates, socio-economic factors and the ways in which copyright works are illegally consumed.

The study Online Copyright Infringement in the European Union, conducted by the European Union Intellectual Property Office (EUIPO), provides important insights in this regard, which help stakeholders to understand the issue and can also be a starting point for public education, which could contribute significantly to addressing the problem.

Source: euipo.europa.eu