In its business policy for 2024, Nova TV Group is counting on an average increase of 18 percent in the price of advertising space.

The expected increase in TV advertising prices for next year has been confirmed by the strongest player in the domestic commercial market in terms of turnover, Nova Group. For 2024, it will increase the price of advertising by an average of 18%. This is the highest increase ever in more than a decade and reflects an increase in CPP and other parameters (see below). “Due to the growing demand for commercial space and the higher costs of programme production, we are forced to increase the average price for clients in 2024 by 18%,” Jan Ulrych, Sales Director of Nova Group, told MediaGuru.cz.

The coefficient for the months of May, June, September, and October is also increased by five percentage points. Similarly, the coefficient for the placement of advertising in off prime time (i.e. outside the broadcast time between 5:30 pm and 11:30 pm) will be increased by five percentage points. Nova will continue to sell advertising space primarily in respect of the 15-54 target group.

New for next year are 10% surcharges for advertising placement in TV Nova’s premiere programmes, for which the TV station expects high demand from advertisers. Another new feature is a 10% late booking surcharge for orders received more than 10 working days after the programme’s release.

“A large number of our long-standing clients have taken the opportunity to sign up for the next year at more favourable pricing terms using the current 2023 parameters before the launch of our new business policy,” Jan Ulrych explained.

The benefits of investments in so-called other media channels (i.e. Nova Sport channels, online channels, product placement, etc.) remain unchanged. It still applies that Nova’s video platform Voyo is not going to introduce advertising yet.

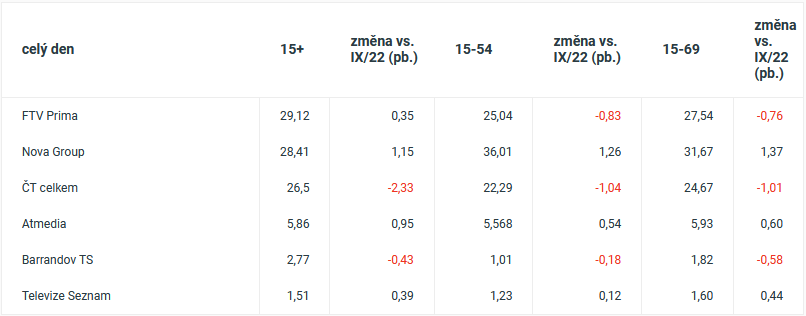

Nova Group achieved the highest share in its primary 15-54 target group of all domestic TV groups this September. It saw a share of 36.01% in daytime and 38.77% in prime time, improving by more than one percentage point year-on-year (source: ATO-Nielsen).

Questions for Jan Ulrych

In the middle of the year, Nova announced that an increase in the price of TV advertising for 2024 was inevitable. How will the basic CPP change for 2024?

Despite the initial nervousness at the beginning of the year on the part of clients, advertising investments began to grow significantly in the second quarter and this trend continued in the autumn months. Due to the growing demand for commercial space, as well as higher costs in producing shows, we are forced to increase the average price to clients by 18% in 2024.

Will TV Nova’s regular and long-term clients receive preferential treatment? If so, how?

Our transparent business policy must apply equal treatment to all market players according to the official terms and conditions. However, it is important to mention that a large number of our long-standing clients took the opportunity to sign up for the next year at more favourable price conditions using the current 2023 parameters before the launch of our new business policy.

What is the design of the new business policy for 2024 based on?

The good news is that the basic principles of business policy for clients remain unchanged. We believe that our clients will appreciate the continuation of the attractive purchasing target group of adults aged 15-54 for the next year. Within the pricing parameters, we have adjusted the coefficient for the 15-second spot footage and increased the coefficients in the busiest months of May, June, September and October by 5 percentage points. In terms of time zones, we are increasing the off-prime time coefficient by 5 percentage points.

What are the other main changes in Nova Group’s business policy for 2024 compared to this year?

We are introducing two new features next year. The first is a 10% surcharge for placing ads in our premiere shows, which we expect to see high demand from advertisers. The other new feature is a 10% late booking surcharge for orders received more than 10 business days after the program’s release. Due to the need to schedule sufficient advertising inventory capacity in time zones, it is important for us to know demand as early as possible. We believe that most clients will prefer to book campaigns early at no extra charge, helping us to optimise ad space while meeting campaign parameters.

What are the benefits of investing in other media channels and is the list of other media channels changing?

The discount policy of GRP sales in conjunction with investments in our other media channels remains the same and is widely used by clients. For example, we offer clients a wide range of options in product placement. We are a leader in content production on the Czech market, and we invest a significant part of our advertising revenues in it. We are expanding the spectrum of genres and the number of formats, we have significantly strengthened long-running formats, and we are shooting new seasons of popular series, currently I can mention the third season of Odznak Vysočina. This autumn, we brought back the legendary Kriminálka Anděl to the screen in its premiere series, and we are really pleased with the results. In our digital division, we are launching mobile apps for our reality shows with commercial promotion opportunities for clients. We have also made significant strides in influencer marketing relating to representing influencers and commercial use for interested clients. And finally, we plan to expand the programming offerings on our sports channels.

Is it still true that Voyo remains ad-free?

Our long-term goal is to make Voyo the number one local player on SVOD platforms and the largest library of local content. We are naturally keeping an eye on the market and the various subscription models used by our global and local competitors. However, we are not considering a change now.

Source: mediaguru.cz