AKA: COMMUNICATION INVESTMENTS TO SEE A DOUBLE DIGIT GROWTH THIS YEAR

The Association of Communication Agencies (AKA) expects marketing communication investments to grow by 12% this year. The investment dynamics is going to accelerate compared to previous years.

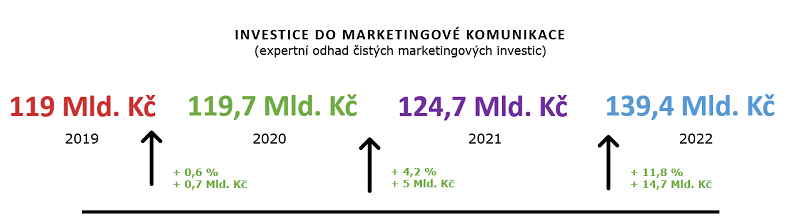

Despite the ongoing presence of Covid-19, the advertising market in the Czech Republic was doing relatively well in 2021. According to data from the Activation Research, which was carried out by Nielsen Admosphere for the Association of Communication Agencies, the market achieved a volume of CZK 124.7 billion (a year-on-year growth of 4.2 %).

“The research results indicate that advertisers have become optimistic again when it comes to investment volumes. Deferred household consumption also played its role,”

says AKA’s director Marek Hlavica.

The research expects that in 2022, the total volume of the market will grow to CZK 139.4 billion, going up by 12% compared to 2021. The advertising market comprises media and non-media channels. In 2022, media investments are expected to grow 6.1% to a total of 77.1 billion, non-media 19.7% to a total of 62.3 billion.

“With the end of the pandemic, we can expect a strong growth in activation campaigns, be it in sales support, or relationship and event marketing. Advertisers’ pressure on meeting their business objectives will be enormous this year, which is supported by the total numbers of the non-media market growth. The market significantly exceeds the expected inflation for 2022,” says David Čermák from AKA’s activation agency section.

INVESTMENTS IN MARKETING COMMUNICATION

(expert estimate of net marketing investments)

in CZK billion

Source: AKA, Nielsen Admosphere

DYNAMICS OF INVESTMENTS IN MEDIA AND NON-MEDIA CHANNELS IN 2021 AND ESTIMATE FOR 2022

media non-media

Source: AKA, Nielsen Admosphere

According to Nielsen Admosphere’s data from spring 2022, retail channels have long been in the top 10 largest advertisers in terms of the volume of invested funds. Lidl, Kaufland and Albert took the top three places again last year. However, compared to 2020, their investments did not see a rapid increase. “Retail chains have maintained their dominant positions. At the same time, it is evident that on one hand, households again started caring for their equipment, and on the other, consumers started taking more care of themselves. Simply, “bread and circuses” is what applies at all times,“ describes the director of the Association of Media Agencies (ASMEA), Ondřej Novák.

Growing online and mobile support

The largest space among non-media channels is taken by online and mobile support, up 27%. It accounts for one fifth of the non-media channel spend. This trend may be expected also in the following years. Marketers expect the largest negative impact in gifts and presents while events and direct marketing have not fully recovered yet. Production of advertising and sponsorship are the main areas that have seen return on investments.

Hourly rates evolve with inflation

The average growth in hourly rates of ad and marketing agencies grew 5.5% year-on-year in January 2022. The reason is the inflation rate in the second half of 2021 and its continued rising trend. As expected, the ad market is growing especially in areas with higher rates of inflation-prone inputs (cost of labour, cost of energy and material needed for advertising production). This is based on the regular annual research of industry hourly rates, showing the average costs on the communication agency market.

State’s communication with people was insufficient

The data from the annual analysis prepared by CEEC Research for AKA and the PR Association (APRA) indicate that the volume of last year’s public contracts accounted for just 1.5% of the total communication market. In total, 686 contracts were awarded in 2021 in the total amount of 1.8 billion. According to AKA, the Czech Republic lags behind West European countries where these contracts represent 15-20% of the market.

Source: mediaguru.cz