The gross volume of advertising investment in the media was higher in the first nine months of this year than in the same period last year, according to the monitoring.

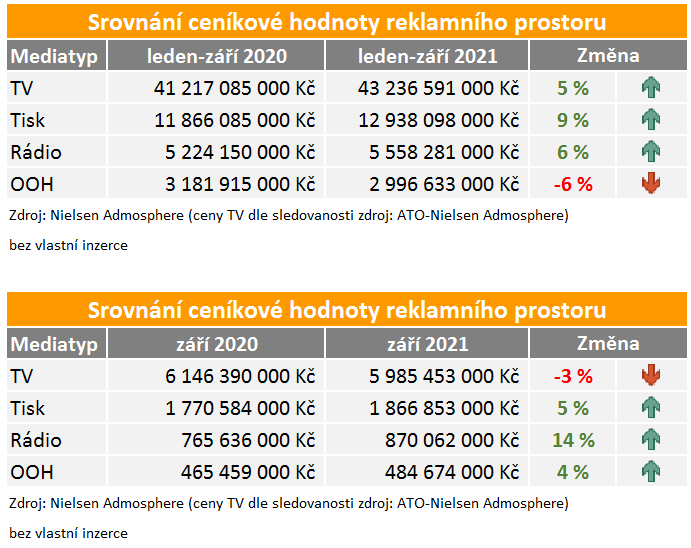

Monitored advertising investment directed towards buying advertising space in media for the first three quarters of this year remains above the level of the comparable period last year, according to Nielsen Admosphere monitoring. They are more than CZK 3 billion higher, representing a 5% increase.

In a year-on-year comparison, all monitored media types improved, according to the monitoring, except for outdoor advertising, whose year-on-year loss was only in single digits. According to the monitoring for the period from January to September, print advertising and radio advertising showed the highest increases. In September alone, radio advertising grew the most (+14%), and print and outdoor advertising were also better off year-on-year, according to the monitoring. Television advertising, on the other hand, declined by 3% y-o-y in September, according to the monitoring data. However, the monitoring data do not cover unplaced advertising, which did not make it onto the air due to the sell-out of advertising space.

The overview does not cover developments in internet advertising, as the monitoring of advertising only captures part of the internet formats. The monitoring of investment data also does not reflect the actual amount of investment that the media receive from advertising. It is a valuation of advertising space based on list prices.

Source: mediaguru.cz