At present, inflation in the Czech Republic reaches the highest values in more than a decade. Its growth will be reflected in the prices of media services.

According to the Czech Statistical Office (CSO), consumer prices have grown 4.1 % year on year in August, which has been the highest increase since November 2008. This development was driven by the prices of goods and services of nearly all sections of the consumer basket. The Czech National Bank (CNB) announced that the year-on-year growth in prices in August was one percentage point faster than predicted by the CNB’s latest forecast. After the removal of anti-epidemic measures, the surge of consumer demand results in higher prices, predominantly in the sector of services, explains CNB.

According to economists, inflation will continue to grow in the following months. “From local factors, the post-Covid price increase in some services or fast growth in property prices, which is reflected in inflation through higher prices of imputed rent, are likely to continue for some time. The price pressures relating to the development on global markets will be influenced by high prices of food, international transport, electricity, gas and other raw and other material,” said Patrik Rožumberský, UniCredit Bank’s analyst.

Miroslav Novák, analyst in Akcenta, predicts that the year-on-year inflation growth will be about four percent at least until the end of this year. A short-term increase to five percent also cannot be excluded. Radomír Jáč, Chief Economist of Generali Investments CEE, is of a similar opinion. “Towards the end of the year, year-on-year inflation may grow above 4.5 percent,” said Jáč.

In the long-term, the growing inflation may impact the prices of media services. According to Pavel Ryska, analyst in J&T, the prices of media services may grow faster due to the growth in consumer prices. “I believe that in the long-term, prices including the media ones will be affected predominantly by the rapid money expansion currently experienced by the Czech economy. The money volume in the Czech economy is growing due to the monetary policy easing by about 10 % per year. To put it simple, it is a rate at which the capability of economic entities to accept higher prices is growing. The current inflation of consumer prices is probably not at its high. At the end of the year, we expect about a five-percent growth. The price growth may accelerate also in media services, which may be driven by their cyclic nature,” he explains.

The rising inflation has an impact on the increase in the costs of human resources, i.e. also on the rise of the costs of media content production. Many foreign film and series production firms shoot in the Czech Republic, which increases the cost of production. Print periodical publishers are facing the growing paper prices. The paper industry addresses the changes caused by the pandemic that resulted in fluctuations of cellulose supply. According to the Czech Statistical Office’s data, the prices in the wood, print and paper sector increased by 24 percent in August. At the same time, there is lack of paper. Some book publishers have already announced that they need to delay the print of their planned book editions. They will also have to reduce the number of book copies intended for Christmas sale.

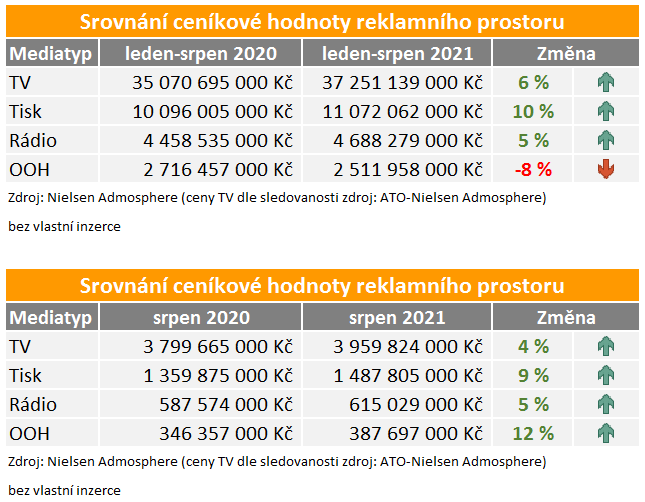

Together with the growing demand for advertising space, another factor influences media companies, which may affect their pricing for the next year. Economic recovery and clients’ ad spend shifted to the second half of this year increase the pressure on ad space. The growing demand on TV as well as on the internet and in radio stations often exceeds demand before 2020, i.e. before Covid.

View of Pavel Ryska, analyst, J&T

In the environment of growing inflation rate, the media segment has an advantage that it is not directly exposed to items whose prices grow the most this year. It is a typical development when in the initial phase of the cycle, prices of commodities such as material, energy, etc. grow the most. That is why production companies are likely to be affected. However, in the longer term, higher inflation may hit all industries, including media. Higher commodity prices are already reflected in the growing prices of consumer goods, which may finally result in higher wage requirements across the economy. It is the labour cost that I believe may affect expenses of the media.

In respect of the costs of media services, I would expect development to follow the economic cycle in the short term. Czech economy experiences recovery. In particular the demand for advertising is usually very cyclic. Some media types (print media, internet and OOH) may profit from the elections to the Chamber of Deputies this year, which tend to temporarily increase the demand for advertising and, as a result, the prices.

I think that in the long term, the rapid money expansion experienced now in the Czech Republic will have a major effect on prices including the media ones. The volume of money in the Czech economy is growing by about 10 % per year due to the eased monetary policy. In a simplified view, we can understand it as the rate at which the capability of economic entities to accept higher prices is growing. The current inflation of consumer prices of 4.1% is likely not to be at its high and at the year end, we expect a rate of about 5%. The growth may accelerate in the prices of media services, which may be facilitated by their cyclic nature.

Source: mediaguru.cz