According to monitoring, the first half of 2021 brought more money from ad sales to the Czech media than the first half of last year.

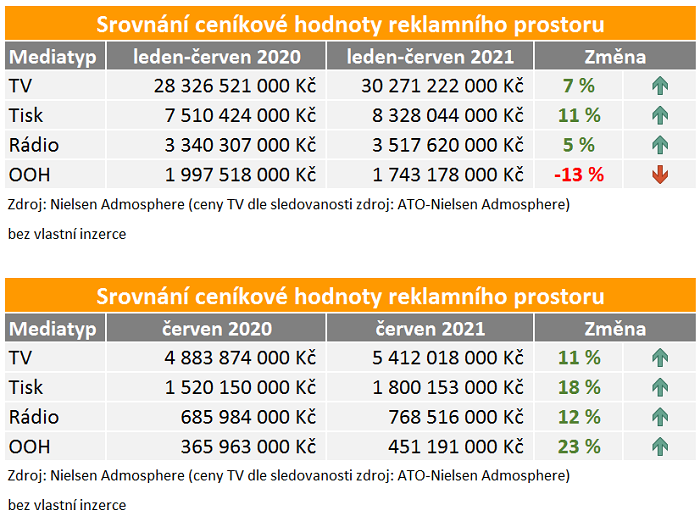

Monitored investments relating to the purchase of ad space in the media in the first half of this year achieved a higher volume than in the same period of 2020, according to the data of AdIntel monitoring by Nielsen Admosphere. In aggregate, they were up six percent (CZK +2.7 billion) year-on-year in the monitored media types (TV, press, radio, OOH).

According to the monitoring, the highest year-on-year increases were achieved by print advertising (+11%) and TV advertising (+7%) in the first half and the volume of investments in radio advertising has also grown (+5%). On the contrary, OOH reported lower investments compared to last year.

This June saw a continued year-on-year growth in investments in all above-mentioned media types, with OOH leading the way (+23%).

The overview excludes comparison of investments in the internet advertising as the monitoring only includes banner and video ads and does not cover other forms of internet advertising.

Please note that the monitored investments do not express real financial volumes, they are based on price list costs and do not include discounts, bonuses or commissions.

Source: mediaguru.cz