How is the Czech economy doing? How are the most important firms in the country doing? And how do the bosses – the leaders of the firms – see the presence and future of the Czech Republic? Answers to these questions are searched in a series of interviews and articles to be found bellow:

We addressed tens of women and men leading Czech businesses. Not only the biggest ones but also the mid-sized ones across various industries. We want to know their experience gained in the most difficult year of the last decade and we want to find out how they has changed and what their direction is. We want to know how the backbone and brain of the Czech economy work and thus how the entire country operates and will operate in future.

Did it all happen so fast? This week, it has been two years since the strongest local TV – Nova – introduced its new co-CEOs: the long-term CFO Klára Brachtlová and the Sales Director Jan Vlček who has similar long-term experience.

Within twenty four months, they had to deal with the move under PPF’s control, changes relating to the coronavirus, huge investments and tragic deaths of people who were key to Nova’s business.

“Turbulent times,” agrees Vlček and Brachtlová adds, “Our appointment was a natural development and then, everything was strongly impacted by external conditions.”

From Barrandov terraces there is an impressive view of the sky above Prague. The clouds disappeared during our double interview for Forbes, which must have been rather symbolic for Nova’s CEOs. According to them, after all Covid adversities their TV is heading for a better future.

“We have many plans and we step on the gas,” agree the bosses. At the same time, they appreciate the model of two CEOs, which is not too usual in the Czech Republic.

“Coordination is more difficult but I keep saying that we complement one another very well and that we are able to substitute each other very effectively. I find it a big advantage not only in these times,” says Brachtlová.

According to Vlček, their long-term personal relationship, mutual trust and respect play a significant role in the arrangement. “We have to be able to rely on each other. Klára comes from the financial background, I was involved in sales and marketing, so we complement one another perfectly.“

Let’s discuss the key moments of your two years in office. How was the TV market impacted by the pandemic?

JV: It was definitely a shock in terms of demand. When the first wave came, the market slumped radically, by tens of percent. Every media type suffered significantly, TV probably came off best in percentage terms. But at the same time, the market was very fast to take a breath and bounce back, after about two months cooperation continued. The second wave surprised everyone by being so long and by locking down economy so thoroughly. But now we can see that clients are planning and starting their activities again.

Has the income from advertising changed for you?

JV: The most strict lockdown occurred before Christmas and as clients plan ahead the autumn investments did not suffer. The second half of the year was very good.

KB: In terms of TV consumption, it was ironically a very successful year, ratings went up significantly. Consumption of streaming platforms has also increased, in this respect, it was a very positive period for TV in fact. People were locked down in their homes and consumed more video content.

What measures did you have to adopt?

KB: We responded very early, in principle at the end of last January. And we were very careful, keeping the measures even in summer when other firms started easing. We strictly divided critical infrastructures into shifts so that the teams did not meet, we built a backup broadcast centre in our premises half a kilometre away, not to mention other preventive measures, such as wearing masks at work or the restricted operation of our canteen.

What was the hardest impact of the pandemic? Was it the impact on your original production?

KB: Definitely in the short term. For me it was the most complicated matter in the spring – in mid-March or so we all of a sudden stopped our production. People were scared, nobody knew what would come next. It had some effect on viewers, we reduced the number of premieres significantly in the spring. But all TV companies joined their forces and a shooting exception was negotiated with the Ministry of Health quite soon. At the end of last May, we were able to start our production again without masks but of course, under strict preventive measures.

JV: We are a company that is modern with considerable digital background, which means that although some teams – such as news production – were hit by the measures more, the rest of the firm was less affected.

We introduced nearly compulsory work from home, a number of things relating to clients were settled through video conferences. And it actually worked very well. People were suffering more socially.

A new owner was another turning point. What has changed with the entry of PPF? Or are the changes going on?

KB: The courtship period and finalisation of the transaction were relatively long and in my opinion, PPF’s entry confirmed the direction and strategy that our TV had followed. PPF is a very strong group ready to invest. It has been fully supporting us in the set direction, which is the production of quality content and its consumption across platforms.

Was the process hit by the sudden death of Petr Kellner?

KB: In the first place, we have to say that what happened to Mr. Kellner is a large human and family tragedy. It had an unbelievable personal impact on all of us, he was a young man, has children… That was the main effect.

As for the firm’s operation, PPF has a broad portfolio of firms with autonomous and very competent managements – I consider Nova to be one of them. In terms of operation, there were no changes, we continue our strategy.

JV: The firm has its plan for many years to come, teams are stable, structures are set up and working well. There are no changes from this perspective, the human aspect is the worst when you think about what happened.

Can anything change with the new owner of PPF?

JV: At the group level, management was assumed by the other co-owner who had been building the firm with Mr. Kellner since the start, for thirty years (Editor’s Note: Ladislav Bartoníček). So nothing has changed.

Radim Pařízek, the head of Digital Broadcasting, died unexpectedly this year as well …

KB: Digital Broadcasting is Nova’s strategic partner and Radim Pařízek was not only a business partner for me but also a close friend, his death touched me greatly.

As for our cooperation with the firm, we go on. Radim’s arrangements were very good, he had a strong team building relationships with the Czech Telecommunication Office and has brought up a strong person to replace him, his daughter. She is taking over the business together with Mr. Jeřábek and I find the firm stable.

Your position is also stable. What is the most challenging aspect of being a clear market leader?

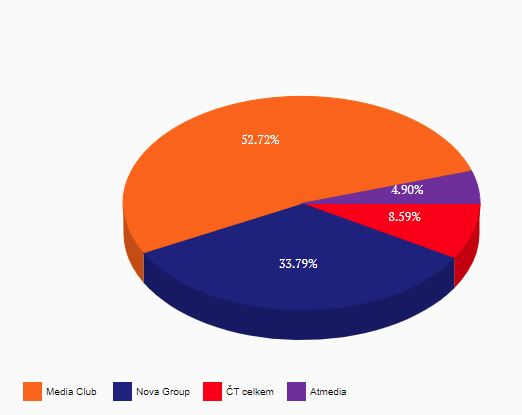

JV: If you are in Nova’s position, you are always the first one who is attacked by those wanting to cut off a piece of the pie. We have been successful in keeping and strengthening our position and we continue growing in a number of areas.

It was not always easy, the TV market was fragmented, there are many more channels than five or ten years ago and the internet has brought considerable fragmentation of media consumption to the media landscape. Habits are changing and so are the target groups in individual media types.

Despite all that you keep your TV ratings.

JV: We are even increasing some of them. The news is an excellent example. The internet as such has brought disruption and we are happy to be in both the TV and online business. With the entry of PPF, we strengthened one of the pillars on which our strategy is built – a paid service funded from subscription. From this point of view, we are also growing in terms of the other pillar, which is being market innovator.

But the pillar is very little for the time being…

JV: We have big targets. Our long-term plan is very ambitious and is focused on digital, our strategy is to change the focus of our business model from a strict B2B approach to being able to adopt B2C, which is represented namely by Voyo. We have some quantified goals that approach a more even distribution of income from services and classic advertising. It is now dominant.

KB: However, TV advertising will remain the key pillar in the income structure.

Are you working with an alternative that digital will be key for you one day?

JV: There is a very interesting aspect that the difference between a combination of TV and digital and a combination of digital and another media type is huge. We can see that TV and digital are complementary. For example, from Voyo we have first-hand experience that every medium can communicate certain things better and their mutual powers are yet to be seen. In this respect, we are not worried that digital might slowly nibble away at TV. They are different things but they strengthen each other.

TV is still the most effective in terms of reach quality.

KB: We take the internet as a supplement, as an additional source of income that is definitely helping us and will help us financing the ever more expensive production of original content. The funds just do not flow from one area to the other.

JV: In addition, TV is still by far the cheapest medium to reach target groups in general – and is likely to keep this position for a very, very long time. TV is also most effective in terms of reach quality, you can show things to people on a big screen, with sound, which emotions. Which is much easier to remember than what target groups in other media can see.

For 2019, Voyo’s revenues were CZK 52 million. Where would you like to get looking forward?

KB: It is a complex and central project, we are working on it with other CME countries. Within five years, we would be very happy to have a million subscribers in the Czech Republic and Slovakia. From this you can count other figures.

Should your viewers expect that part of your production will go to Voyo only?

KB: We will not specify the level of investments but in terms of numbers of planned formats and shows, viewers will be affected this autumn when some shows will be shown primarily on Voyo. At least one format will go just to Voyo in the autumn, we are also planning a great show Love Island that will be run on both linear TV and Voyo.

How is the appropriate strategy sought in this respect?

KB: It is alchemy. The programming strategy has many variables: what our competitors are doing, what the power of the public TV is at the moment; working with target groups is also very important. Everyone expects that younger viewers will go to Voyo to see more adventurous formats than the classic linear TV viewers. This is the starting point.

JV: At the moment, we are preparing repositioning of TV channels, which is part of the alchemy. We seek to address individual target groups more effectively. There are more things to come. We want to optimise the existing portfolio of channels.

Can there be a change in the number of channels?

JV: Everything is open, we will see. We can expect the rebranding and repositioning project this year.

Is it still true that your target group is defined by age as 15–54? Does the young generation watch TV?

JV: There is an interesting effect. Teenagers tend to consume things more on digital displays but when they settle down, have their homes and families they come back to the more standard model, consuming TV. That is what matches their lifestyle. It is true that we reach the youngest groups either through targeted TV shows or by digital. But when we talk about category 20+, there is a return to the standard model.

KB: In addition, there are TV formats that are directed at substantially younger audiences, such as Pop Idol (SuperStar).

You increase investments in your original production by thirty percent year-on-year. What are they used for?

KB: For linear TV, we are working on the TV series Pan profesor starring Vojtěch Dyk and we are preparing a great surprise – we are working on the redesign of our newsroom. Viewers will have a chance to see one of the most modern studios in Europe this year. It is also a large investment.

We invited the world-famous studio Veech x Veech to cooperate with us and they made the design for us. And we are back at the alchemy: we had alternatives to choose from to the best of our knowledge and belief and the board has selected the one that we believe is the best.

Will the footage change? And the news faces?

KB: The change relates to the technological part and design so that the newsroom is modern and follows current trends.

JV: The concept of the studio should be more versatile so that it may be used for projects on the internet.

KB: We are working on it intensively and it will be ready soon, within months. We really have a lot to do now. This period is very challenging but great for us.

Are there any news to be introduced in the traditionally slower summer season?

KB: Apart from investing much, we are good economists. People are outside, they are not willing to watch TV and we need to make an effective use of our money. That is why we concentrate on the strongest seasons, which are autumn and spring.

JV: At the same time, in summer we can monitor behaviour of viewers who spend more time outside. We focus on what to offer them on Nova Plus, Voyo – so that they have more shows and can watch them wherever they want to.

Nova has always considered the idea of paid terrestrial broadcasting. What is the situation now?

KB: Our goal is to always, continuously and permanently maximize our content monetization. It is no secret that this is one of the ways. But as you have heard, we have a lot to do, we are stepping on the gas but having too many goals is tiring. It is an alternative that we have been taking into consideration for a long time, it fits perfectly in TV Nova’s strategy. But all in good time.

JV: We are making projections and analyses. It would be a way to further diversify our income but it is not a simple solution.

Source: forbes.cz